Content

- What Are Alternatives To New Mexico Payday Loans?

- #3 Cashusa: Leading Company For Fast Cash Loans Online

- #1 Moneymutual: Overall Best Platform For $255 Payday Loans

- Q3 Is There A Difference Between Payday Loans And Online Personal Loans?

- Concluding On $255 Payday Loans With Guaranteed Approval

- Important Information About Payday Loans In Texas

Everyone who needs a short-term loan has easy access to the AutoLoansCreditArticles.com service. Rules and forms are simple enough that anyone can follow them and connect with a lender without difficulty. Certain lenders work exclusively based on credit, while others specialize in specific types of loans. Having negative credit doesn’t mean you can’t get a small personal loan.

- If you’re not certain whether a lender is reputable and legal, you can contact the state attorney’s office for further information.

- To help you estimate fees and rates, there is an online calculator.

- The guides have expert-written articles that might help you make thoughtful loan choices.

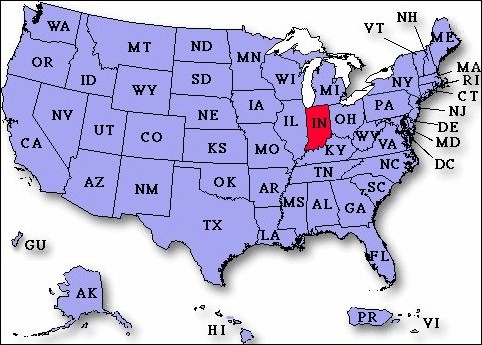

- For example, here is a look at the maximum allowed percentage pate for payday loans by state based on a $100, 14-day loan.

- The network requires its lenders to disclose information concerning interest rates, repayment terms, terms and conditions, and origination fees.

Every client require a lively mankind bank-account for one’s speedy dollars pass. If acquiring an on-line obligations, don’t forget financing cases trust your own personal bank. To come mortgage, the degree of financial support uses the financing maximum assigned out-of the providers. The money get better count have a tendency to consist of $one hundred to $1000.

What Are Alternatives To New Mexico Payday Loans?

The subsequent stage is pretty tedious for customers because they must await communication from a lender. Once you complete your application, several online lenders will review it and will determine whether or not to deal with you. A lot of consumers value the versatility and wide range of available options the most. By utilizing PersonaLoans, you can obtain all information management to determine which deal is ideal for you without feeling obligated to sign anything immediately. This is primarily one of several best locations for anyone experiencing money troubles to satisfy their funding requirements fully. The final step is to go through the offer and check all the details.

#3 Cashusa: Leading Company For Fast Cash Loans Online

Though presenting lots of beneficial things, fees of online payday loans Brunswick in Georgia make some people stop getting it. When deciding on becoming a client, you need to choose the desired amount of money. Thanks to such a service, the available sums are from $30 up to $1000. The fee, which is taken by lenders, depends on the sum of money and could be, for instance, $1 from each $5. Acquiring large loan amounts can be a massive hassle as not every lender provides them.

#1 Moneymutual: Overall Best Platform For $255 Payday Loans

For example, military members can find a payday loan designed especially for their working position. These loans are made to finance the active military members who face unpredictable financial challenges. Military member clients should mention their working position in the application form. Before taking out an easy loan, be sure to explore all of your borrowing options. This can help you pay as little interest as possible or get the best deal.

Q3 Is There A Difference Between Payday Loans And Online Personal Loans?

It’s rare to find upfront and honest business with its customers, but some do exist. Before accepting a loan from a company listed on this page, you’ll know all the terms and circumstances. Applying and being accepted for an account both take around five minutes.

Concluding On $255 Payday Loans With Guaranteed Approval

In fact, Upstart estimates that it has been able to approve 27% more borrowers than possible under a traditional lending model. With competitive APRs, Upstart is not a top lender for borrowers who can qualify for more competitive rates. Even so, the platform’s minimum 600 credit score makes it an accessible option to those with fair credit. In general, loans are available from $2,500 to $35,000 and may be issued for between three and seven years.

Overall, the company also has an Excellent Trustpilot customer rating, suggesting that you’ll be satisfied with the service experience. Moreover, the company has arguably the best average loan interest rates we’ve seen, and they guarantee that. Furthermore, Credible lets you see your pre-qualified loan interest rates from the start, and it’s all free.